Is Bitcoin The Real Flight To Safety?

Is Bitcoin The Real Flight To Safety?

Wall Street's recession sirens are blaring — and as traditional markets brace for impact, Bitcoin's (CRYPTO: BTC) defiant rally has investors asking: is this digital gold 2.0 or just fool's gold with better marketing?

華爾街的衰退警報已經響起——隨着傳統市場準備迎接衝擊,比特幣(加密貨幣:BTC)的反抗性反彈讓投資者疑問:這是數字黃金2.0,還是僅僅用更好的營銷包裝的愚人黃金?

Big Banks Turn Bearish, And Fast

大銀行迅速看淡

Recession probability forecasts aren't just creeping up — they're sprinting. In the span of days, JPMorgan hiked its odds of a U.S. recession from 40% to 60%, while S&P Global jumped from 25% to 35%. Goldman Sachs and HSBC weren't far behind, now both penciling in a 35%–40% chance.

衰退概率預測不僅在上升——而是快速攀升。在短短几天內,摩根大通將美國衰退的概率從40%提高到了60%,而標普全球則從25%跳升至35%。高盛和匯豐也緊隨其後,現在都預計衰退的概率在35%到40%之間。

Related: JPMorgan Raises Recession Risk To 60% As 'Largest US Tax Hike' In 60 Years Hits Global Economy

相關:摩根大通將衰退風險上調至60%,因爲"60年來最大的美國增稅"衝擊全球經濟

"There can be no doubt that fears of a U.S. recession are intensifying," warned James Toledano, COO of Unity Wallet. "Economic growth is forecast to stall at anywhere between 0.1% and 1%, and many believe these risks are already priced into equities, but I am not so sure that we've even seen the bottom."

"毫無疑問,美國衰退的恐懼正在加劇," Unity Wallet的首席運營官詹姆斯·託萊達諾警告道。"經濟增長預計將在0.1%到1%之間停滯,許多人認爲這些風險已經反映在股票中,但我不太確定我們是否已經見底。"

For investors looking to tactically position around a recession scenario, the Direxion Daily S&P 500 Bear 3X Shares (NYSE:SPXS) or the Direxion Daily Total Bond Market Bear 1X Shares (NYSE:SAGG) could offer hedges if equities and bonds take a dive. On the flip side, safe-haven sectors like utilities and staples — accessible via the Utilities Select Sector SPDR ETF (NYSE:XLU) or the Consumer Staples Select Sector SPDR Fund (NYSE:XLP) – may see relative outperformance.

對於希望在衰退情景中進行戰術佈局的投資者來說,Direxion每日S&P 500看淡3倍基金(紐交所:SPXS)或Direxion每日總債券市場看淡1倍基金(紐交所:SAGG)可以提供對沖,如果股票和債券大幅下跌。另一方面,像公用事業和日常消費品這樣的避險板塊——可通過公用事業精選行業指數ETF(紐交所:XLU)或日常消費品精選行業指數ETF-SPDR(紐交所:XLP)獲得——可能會相對錶現優異。

Bitcoin Climbs As Uncertainty Grows

比特幣在不確定性增加時攀升

Meanwhile, Bitcoin has been showing some real swagger — up over 25% in six months and hovering near $86,000. But it's been reluctant to charge past that level.

與此同時,比特幣展現出真正的傲氣——在六個月內上漲超過25%,並徘徊在86,000美元附近。但它一直不願意突破這一水平。

"Bitcoin's appeal as a decentralized asset grows, especially as traditional markets face volatility," said Toledano. "While Trump's policies have introduced significant macroeconomic uncertainty, they may paradoxically be fueling Bitcoin's recent rise — though the risks remain elevated for all markets, crypto included."

「比特幣作爲一種去中心化資產的吸引力在增長,特別是在傳統市場面臨波動時,」Toledano說。「雖然特朗普的政策帶來了顯著的宏觀經濟不確定性,但這些政策可能悖論地推動了比特幣最近的上漲——儘管所有市場,包括加密貨幣,風險依然很高。」

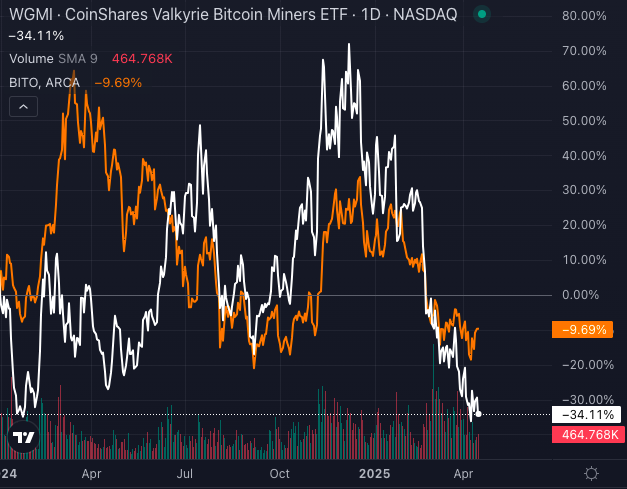

Chart created using Benzinga Pro

圖表使用Benzinga Pro創建

Still, if a deep recession hits, will retail investors continue to HODL — or will the thrill give way to fear?

然而,如果深度衰退來臨,零售投資者會繼續持有嗎——還是興奮感將讓位於恐懼?

For those betting that crypto's momentum holds, the CoinShares Valkyrie Bitcoin Miners ETF (NYSE:WGMI) or the ProShares Bitcoin Strategy ETF (NYSE:BITO) provide entry points to ride the wave — without having to hold digital wallets.

對於那些押注加密貨幣勢頭持續的人來說,CoinShares Valkyrie比特幣礦工可交易ETF(紐交所:WGMI)或ProShares比特幣策略可交易ETF(紐交所:BITO)提供了不需要持有數字錢包的入場點,可以乘勢而上。

As recession odds surge and markets wobble, Bitcoin may be the bold bet — but don't forget, volatility cuts both ways.

隨着衰退幾率激增,市場動盪,比特幣可能是一個大膽的押注——但不要忘記,波動性是有雙向的影響。

"There can be no doubt that fears of a U.S. recession are intensifying," warned

"There can be no doubt that fears of a U.S. recession are intensifying," warned