$Taiwan Semiconductor (TSM.US)$ recently touched the $1 trillion market cap again. TSMC's journey to this milestone is a testament to its strategic foresight and operational excellence. Here, we delve into three significant factors that have propelled TSMC to its dominant position in the global semiconductor industry.

Innovative business model

One of TSMC's most groundbreaking contributions to the semiconductor industry is its innovative business model, which pioneered the fabless-foundry paradigm. Before TSMC's inception, the industry was dominated by Integrated Device Manufacturers (IDMs) like Intel and AMD, which managed the entire semiconductor production chain from design to manufacturing. This model required substantial capital investment, limiting technological advancements to only a few major players.

TSMC, under the visionary leadership of its founder, Morris Chang, redefined this landscape by focusing solely on chip manufacturing and not on chip design. This separation allowed them to serve as an enabler for countless IC design companies to innovate without the burden of manufacturing. By doing so, TSMC fostered a new ecosystem where design companies could thrive, leading to significant industry growth and diversification. Companies such as Qualcomm, NVIDIA, and Broadcom have benefited from this model, which has ultimately reshaped the semiconductor industry globally.

Commitment to customer trust and collaboration

TSMC's business ethos of "never competing with customers" has been a cornerstone of its success. This principle has allowed TSMC to cultivate profound relationships with its clients, offering a level of trust and collaboration that is unparalleled in the industry. Unlike its competitors, which often have internal design teams that could potentially compete with their customers, TSMC's singular focus on manufacturing ensures that there are no conflicts of interest.

TSMC's business ethos of "never competing with customers" has been a cornerstone of its success. This principle has allowed TSMC to cultivate profound relationships with its clients, offering a level of trust and collaboration that is unparalleled in the industry. Unlike its competitors, which often have internal design teams that could potentially compete with their customers, TSMC's singular focus on manufacturing ensures that there are no conflicts of interest.

This commitment to customer service is exemplified by TSMC's relationship with Apple. Initially, Apple employed a dual-supplier strategy for its A9 processors but later chose TSMC as its exclusive supplier for the A10 chip due to the trust and reliability TSMC offered. This move was not solely based on TSMC's technological capabilities but also on the assurance that its proprietary designs would remain confidential and uncompromised. Such trust-based partnerships have been pivotal in cementing TSMC's reputation as a customer-centric leader in the semiconductor foundry space.

Technological leadership and strategic innovation

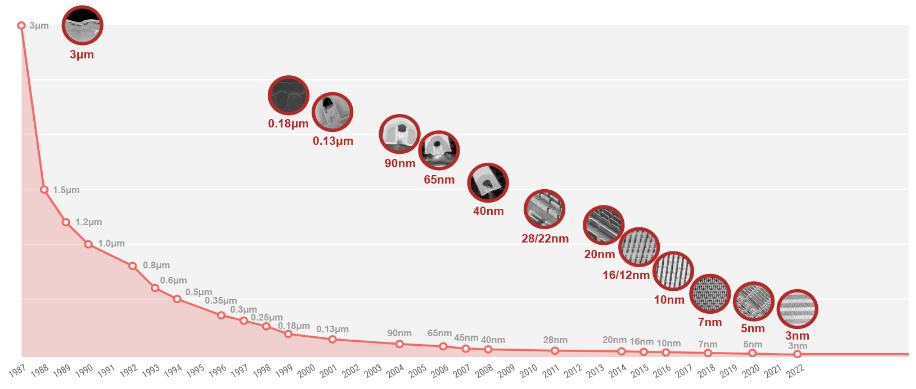

TSMC's relentless pursuit of technological innovation is another critical factor contributing to its success. From its early days with 3-micron technology to today's cutting-edge 3-nanometer process, TSMC has maintained a pace of introducing a new process node roughly every two years. This commitment to innovation has allowed TSMC to attract and retain high-profile clients like Apple, Qualcomm, and NVIDIA.

For instance, at the 28-nanometer node, TSMC opted for the gate-last process technology, which eventually proved superior to the gate-first approach taken by others, such as GlobalFoundries and Samsung. This decision enabled TSMC to achieve higher yields and performance, further solidifying its leadership position. Moreover, TSMC's foray into advanced packaging technologies, like CoWoS (Chip-on-Wafer-on-Substrate), has opened new avenues for high-performance computing and AI applications, offering significant value to its clients.

In conclusion, TSMC's ascent to a trillion-dollar market cap is no accident but a result of its innovative business model, unwavering customer trust, and technological superiority. As TSMC continues to drive forward, it not only sets benchmarks for the semiconductor industry but also serves as an inspiring example of strategic growth and innovation.