$Agora (API.US)$ Following the introduction of China's groundbreaking DeepSeek technology, Wall Street giants Goldman Sachs and Deutsche Bank have revised their investment outlooks for the Chinese market. Goldman Sachs released a report on Tuesday forecasting a 14% potential increase in the MSCI China Index for the year. Shortly thereafter, Deutsche Bank also expressed optimism, advising investors to actively engage with the Chinese market. They noted that Chinese assets are at the nascent stages of a bull market with expectations to reach new heights in the medium term.

The debut of DeepSeek signifies a major leap in global technological competition for China.

This artificial intelligence system not only underscores China's competitive edge in high-tech sectors but also highlights the growing dominance of Chinese companies on the global stage. Deutsche Bank analysts have likened the success of DeepSeek to China's "Sputnik moment," a pivotal time when a nation's technological and innovative prowess is internationally acknowledged.

Deutsche Bank states that global investors often significantly underweight China in their portfolios, emphasizing that the current performance of Chinese companies, particularly in contrast to Western firms, should not be ignored. The manufacturing sector in China has shown remarkable strength, especially in industries like basic electronics, steel, and shipbuilding. By 2025, China is also expected to launch the world's first sixth-generation fighter jet, reinforcing its leadership in high-end manufacturing and complex industrial fields.

Deutsche Bank states that global investors often significantly underweight China in their portfolios, emphasizing that the current performance of Chinese companies, particularly in contrast to Western firms, should not be ignored. The manufacturing sector in China has shown remarkable strength, especially in industries like basic electronics, steel, and shipbuilding. By 2025, China is also expected to launch the world's first sixth-generation fighter jet, reinforcing its leadership in high-end manufacturing and complex industrial fields.

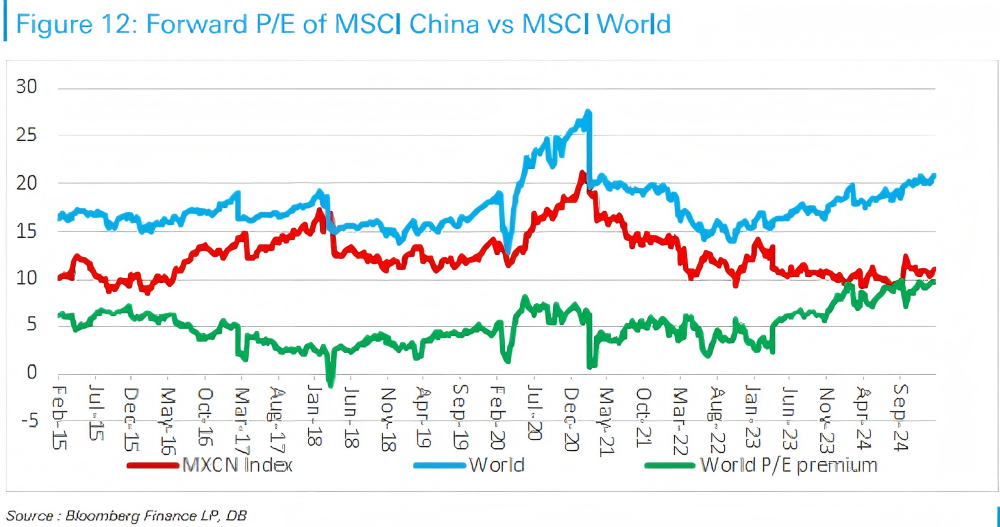

Furthermore, Deutsche Bank anticipates that the existing "valuation discount" on China's stock market will gradually vanish. Enhanced by supportive policies and financial liberalization, this adjustment is poised to catalyze continued growth. The bull market that began in 2024 within the A-share and Hong Kong stock markets is projected to sustain its momentum and exceed previous peaks in the coming years.

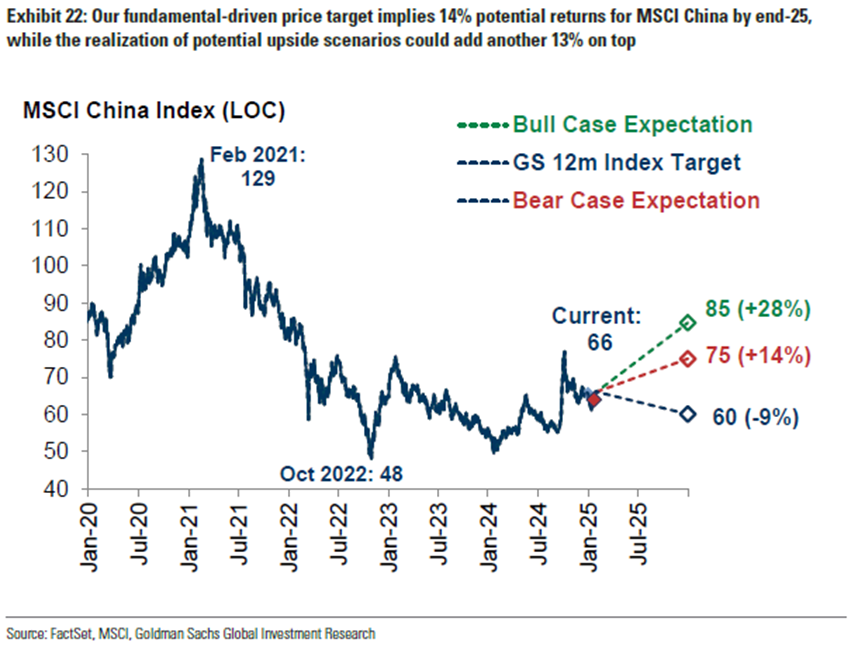

Goldman Sachs projects a 14% rise in the MSCI China Index this year

According to a recent report, the MSCI China Index is currently positioned at approximately 66 points. Goldman Sachs predicts a potential increase to 75 points under a neutral scenario. In a more optimistic forecast, the index could surge by as much as 28%.

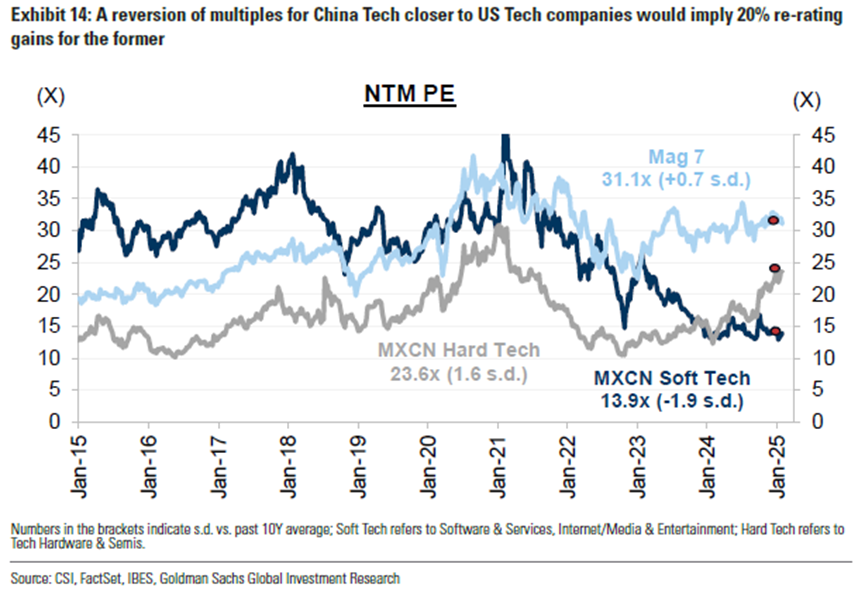

The bank highlights the launch of DeepSeek as a pivotal development in the artificial intelligence sector, marking a shift from hardware infrastructure to software applications. This transformation challenges the traditional notion of "American exceptionalism" and opens up new avenues for diversified growth in the global market, particularly benefiting Chinese tech stocks. Goldman Sachs is especially optimistic about the prospects for Chinese tech stocks, citing potential productivity boosts and technological advancements that could help narrow the significant valuation gap—up to 66%—between U.S. and Chinese tech or semiconductor stocks.

It's time to pay attention to Chinese tech stocks

During the Spring Festival, Chinese assets showed strong performance, with the FTSE China A50 futures increasing by 1.85% and the Nasdaq Golden Dragon China Index rising by 1.15% from January 28 to January 31. AI-related Chinese companies such as Agora $Agora (API.US)$ , Kingsoft Cloud $Kingsoft Cloud (KC.US)$ , and Alibaba $Alibaba (BABA.US)$ experienced notable gains of 16%, 11%, and 10%, respectively, drawing significant investor interest.

The buzz around DeepSeek, particularly its ability to deliver performance comparable to GPT but at a lower cost, has led investors to reevaluate the technological capabilities of Chinese tech firms in the AI space. Reports from JPMorgan and Citibank suggest that DeepSeek has catalyzed six major AI investment opportunities, with companies like Alibaba, Tencent, Kingdee, and Xiaomi poised to benefit.

Overall, among global technology-related investment opportunities, Chinese tech stocks are likely to gain increasing recognition. The potential and influence of the Chinese market are significant and should not be underestimated by global investors, who are advised to keep a close watch on these developments. Moreover, with the U.S.-China trade war quietly escalating, investors are also cautioned to consider its potential negative impacts.